This article is an on-site version of our FirstFT newsletter. Subscribers can sign up to our Asia, Europe/Africa or Americas edition to receive the newsletter every weekday. Explore all of our newsletters here

Good morning. Today we’re covering:

-

Huawei to launch phone with own software in sign of China-US splintering

-

UniCredit makes €10bn offer for Italian rival Banco BPM

-

Yemeni mercenaries duped into joining Russia’s war by Houthi-linked group

-

US retailers are extending Black Friday deals into a sales event lasting weeks

Huawei is poised to launch its first flagship phone that can run its own apps on a homegrown operating system, in the latest sign of how technology is dividing into competing US and Chinese ecosystems.

The smartphone will feature HarmonyOS Next, which the Chinese company hopes to establish as a major rival to Apple’s iOS and Google’s Android.

It is the latest demonstration that US sanctions designed to enfeeble the company have instead cemented Huawei’s status as a technological juggernaut. Last month, the group reported sales jumped 30 per cent from a year earlier in the first nine months of 2024.

The software launch on the Mate 70 builds on hardware momentum from last year, when the group unveiled the Mate 60, powered by a self-developed and domestically made processor capable of near 5G speeds — a feat many in Washington believed was not possible.

“This is a significant turning point for China, it’s being driven by the fear that the US could cut off everything,” said Paul Triolo, a tech expert at Albright Stonebridge Group. Read more on this story.

Here’s what else we’re keeping tabs on today:

-

Companies: A London tribunal begins hearing the appeal against a £50mn fine levied on Barclays by the Financial Conduct Authority over its 2008 fundraising with Qatar.

-

Economic data: The November ifo German business climate survey is published.

-

Monetary policy: Bank of England deputy governor for monetary policy Clare Lombardelli speaks at the third BoE Watchers’ Conference.

Five more top stories

1. US retailers are extending one-day Black Friday discount offers into a sales event lasting weeks in a bid to tempt US consumers to keep spending, as data suggests that their spree that has driven economic growth is beginning to falter. Here are the retailers already offering deep seasonal discounts.

-

Film industry: Wicked and Gladiator II took in $385mn worldwide at the weekend, giving cinemas hope for a strong holiday box office.

-

Music industry: The sector’s revenues last year overtook cinema’s pre-pandemic sales peak, on the back of booming streaming platforms.

2. Exclusive: France has dropped its opposition to non-EU companies accessing EU-funded financial incentives for Europe’s defence industry, as the bloc pushes to develop a stronger domestic arms industry less dependent on the US. Henry Foy and Paola Tamma have more details from Brussels.

-

Defence race: Europe has been building up its defence base, but change will need to happen fast to make a difference to regional security, writes Arizona State University’s Candace Rondeaux.

3. Exclusive: Russia’s armed forces have recruited hundreds of Yemeni men to fight in Ukraine, brought by a shadowy trafficking operation that highlights the growing links between Moscow and the Houthi rebel group. We have more details here, including interviews with Yemeni recruits who said they were tricked or threatened into signing Russia contracts.

4. Italy’s UniCredit has launched a €10.1bn takeover bid for rival Banco BPM, as chief executive Andrea Orcel steps up his efforts to consolidate Europe’s fragmented banking industry. The offer opens a new front for Orcel’s ambition to create a European banking champion.

5. Fatalities in the Sahel have soared as military juntas fail to contain a surge in jihadi violence in Africa’s “coup belt”. There were a record 7,620 such deaths across Mali, Burkina Faso and Niger in the first half of this year, according to a non-profit group, up 190 per cent from the same time in 2021.

The Big Read

For 75 years, the US has played an outsized role in Nato. Yet Donald Trump’s return to the White House has raised the spectre of a war in Europe in which Nato allies may no longer be able to count on full American support — or maybe any US support at all. “Europeans are going to have to pick up more of the burden,” one European official said. “The question is whether this will be a managed process or a chaotic one.”

We’re also reading . . .

-

Winter in Gaza: Aid officials warn that rains threaten to unleash a deluge of sewage for displaced people living in tents in the territory as temperatures fall.

-

Northvolt dilemma: The Swedish battery group’s fall has left Europe struggling over how to recraft its electric vehicle strategy to compete with China.

-

UK pensions: Pension arrangements shape national prosperity over multiple generations, and “long-termism” is the only sane approach, writes Martin Wolf.

-

Techno-libertarians: Silicon Valley billionaires are selling a dream of unfettered markets — but reality is not so certain, writes Rana Foroohar.

Chart of the day

US monetary policy is on course to sharply diverge from Europe, with the Federal Reserve set to cut its benchmark interest rate only half as much by the end of next year as the European Central Bank. With Trump preparing to cut taxes and increase tariffs, US inflation is forecast to stay above 2 per cent throughout the whole of 2025.

Take a break from the news

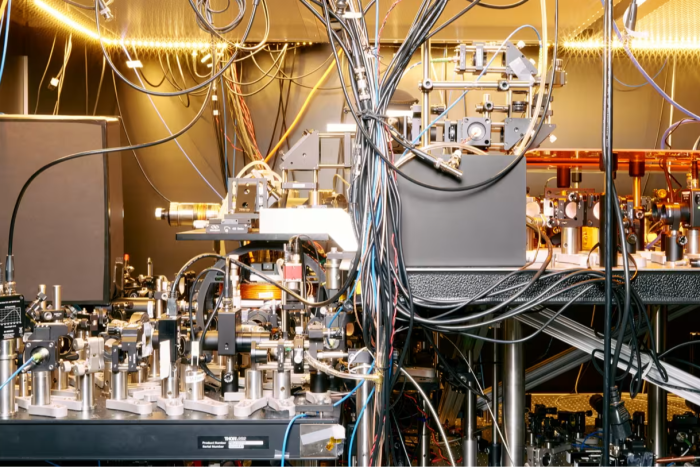

How long is a second? Oliver Roeder looks at the mind-bending new science of measuring time, as physicists grapple with fundamental questions that have international political implications.

Additional contributions from Tee Zhuo and Benjamin Wilhelm

This post was originally published on here