Sun Pharmaceuticals has developed a sizeable portfolio of speciality products that the company can now be seen as a speciality player. The existing speciality portfolio is powering earnings and the company is developing a pipeline for the next leg of growth. We earlier recommended that investors hold the stock in bl.portfolio edition dated January 2, 2022. But with the company on such sure footing, we revise our call and recommend investors to accumulate the stock on dips. The only headwind is valuations with Sun Pharma trading at 34 times one-year forward EPS or 36 per cent premium to 10-year average along with sector valuations also expanding 15 per cent in 2024 to 30 times.

Speciality portfolio

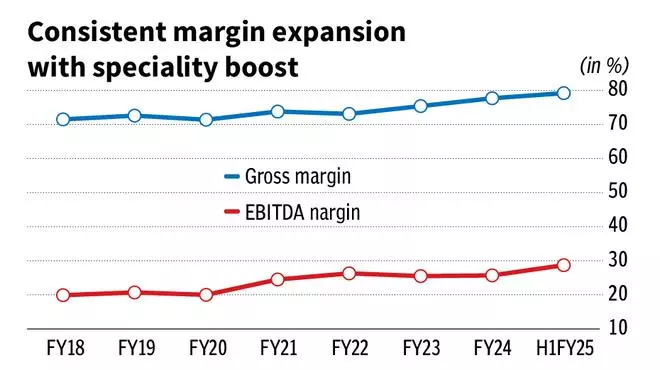

Global speciality revenues accounted for 18 per cent of FY24 revenues from 7 per cent in FY18. The impact of the same is witnessed in margins and balance-sheet strength of the company. The gross and EBITDA margins have expanded from an average of 73 per cent/23 per cent in FY16-20 to 78 per cent/28 per cent in H1FY25. Sun Pharma has a net cash of around ₹7,000 crore in September 2024.

Sun Pharma’s speciality products are in Dermatology, Ophthalmology and Onco-derma therapies including the anchor product Ilumya (for plaque psoriasis), which generated sales of $580 million in FY24. Winlevi (acne), Cequa (dry eye disease) and Odomzo (basal cell carcinoma) are the other leading products.

Ilumya has yet to reach its peak sales as inferred from the strong 22 per cent year-on-year growth in FY24. This can be driven by global markets including Europe and China, where it is partnered for marketing along the US markets. But the lifecycle management in the US post 2031 when patents are likely to expire will have to be watched. Cequa and Winlevi are in an earlier phase of growth and are expected to ramp up sales further.

The pipeline includes several other potential products. Ilumya is in trials for Psoriartic Arthritis as well, which is an additional indication. This can potentially add 15-20 per cent to existing sales when approved. In October 2024, Sun Pharma and Philogen have announced an exclusive global licencing agreement for Fibromun, a product under clinical trials for soft tissue sarcoma (Phase-3) and glioblastoma (Phase-2). Philogen will conduct the studies and generate marketing authorisations and manufacture the product and Sun Pharma will commercialise the product for a 55 per cent share. Other studies, which are equally large in opportunity, are MM-II about enter Phase-3 for osteoarthritis, SCD-044 for atopic dermatitis in Phase 2 and GL0034, a GLP product (leading class in diabetes) for obesity about to enter Phase-2. Sun Pharma is also working on a portfolio of GLP generics for diabetes in global studies. This is targeting a flurry of patent expires in the lucrative space during 2027-30.

But Sun Pharma has almost secured an ‘Ilumya’-sized opportunity. Deuruxolitinib, now named Leqselvi after approval in July 2024, was acquired as part of the $576-million acquisition of Concert Pharma in 2023. The product is approved for alopecia areata. Assuming Sun Pharma secures 5 per cent share of the patient population by the eighth year and pricing of $50,000 per year (similar to peers), the product can generate peak sales of $500 million, which can make it the second-largest product for Sun Pharma. While approval has been received, Incyte, a leading auto-immune player, has successfully filed an injunction based on infringement of one patent. The appeal must be monitored with the least-favourable scenario being delay for two years when the patent expires or a high royalty. Sun Pharma also has contingent payment based on milestones to erstwhile Concert Pharma shareholders of more than $200 million, which combined with the royalty can eat into the profit share of Sun Pharma.

Sun Pharma has transitioned from one speciality product to a complete portfolio in the Onco-Derma space, which is now capable of self-sustaining the global speciality momentum.

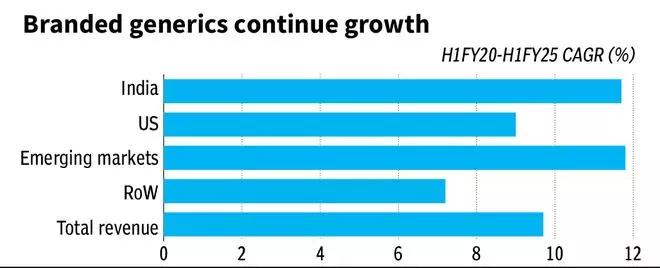

All through this, Sun Pharma has not taken eyes off India-branded generics market and other markets, where it has a significant presence. Sun Pharma has grown above the Indian Pharma market growth rate, as it is a leading player and has supplemented its sales force significantly in the last three years. The other regulated markets are benefitting from the speciality portfolio as well with parallel sales.

The strong balance sheet allowing for M&A opportunities, the high margin business allowing for elevated R&D commitments (7-8 per cent of sales) should sustain the speciality build-up of Sun Pharma along with leading presence in branded generics in India and other segments.

This post was originally published on here