No Cup Day rate cut seen as sure bet: CBA

The Reserve Bank’s new, less frequent meeting schedule hasn’t done away with the Melbourne Cup day board meeting — we’ll get the latest interest rate decision this coming Tuesday, half an hour before the race that stops the nation at Flemington.

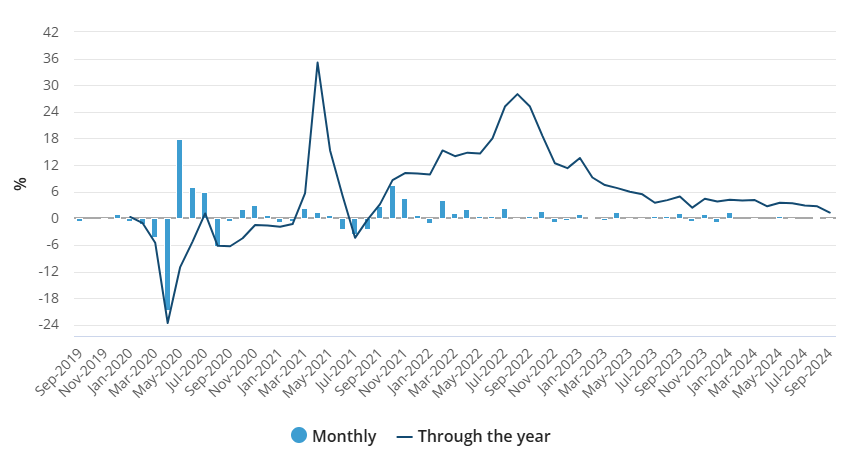

After this week’s inflation figures showed price pressures easing off, but the RBA’s preferred measure of underlying inflation — the trimmed mean — remaining above its target, no change to rates this month or next is looking like the surest bet.

Commonwealth Bank economists had predicted a rate cut in December but with the trimmed mean coming in higher than they had forecast, they now don’t see that happening until February.

Here’s what CBA’s head of Australian economics Gareth Aird has to say ahead of next week’s RBA meeting:

We expect the cash rate will be left on hold and see the chance of any other outcome as trivial…

CBA had forecast a lower outcome for trimmed mean inflation, which had underpinned our view that the RBA could commence normalising the cash rate in December.

We jettisoned that call after the data dropped as the trimmed mean outcome was simply not low enough to see the RBA cut rates this calendar year.

Our base case is now for a first cut in the cash rate in February 2025.

Notwithstanding the change to our call, the inflation data confirmed that the disinflation process has continued.

This will be welcomed by the RBA. Indeed we expect the Board to acknowledge the fall in both headline and core inflation in its Statement on Tuesday…

The upshot is that the latest inflation data will leave the Board more assured that core inflation is on its return sustainably to the target band. And therefore the current policy settings are appropriate. This should mean an on‑hold decision next week is straight forward.

…The Board appears to be fond of the line that it is ‘not ruling anything in or out’ as it does not paint them into a corner. But we are approaching the point at which the Board should feel confident that the next move in rates will be down and not up. Put another way, the RBA’s communication should start to reflect the balance of risks to the monetary policy outlook…

In summary we expect some moderation in language from the RBA next week that implies another rate increase is less likely than previously telegraphed.

Property investors remain in market near record levels

Property investors aren’t fleeing the market just yet, despite talk of potential changes to tax breaks and the continued pressure of high interest rates.

The latest lending data from the ABS shows the value of investor loans down 1 per cent in September at $11.6 billion — that’s nearly 30 per cent higher than a year ago, and just slightly off the record high in January 2022.

The value of owner-occupier loans rose 0.1 per cent to $18.6 billion — 13 per cent higher than last September.

First home buyers activity declined in the month, with the value of FHB loans down 3.3 per cent but that’s still nearly 9 per cent higher than September 2023.

The number of FHB loans also fell, with around a third of new loans to first-time borrowers coming out of Victoria, followed by NSW and Queensland.

Here’s what ABS head of finance statistics Mish Tan made of the data:

“Over the past 18 months, the average size of loans approved increased for both owner-occupiers and investors.

“However, the growth in investor loans was also driven by increases in the number of loans being approved.

“Investor activity remains at high levels in response to the recent growth in house prices and rental yields.”

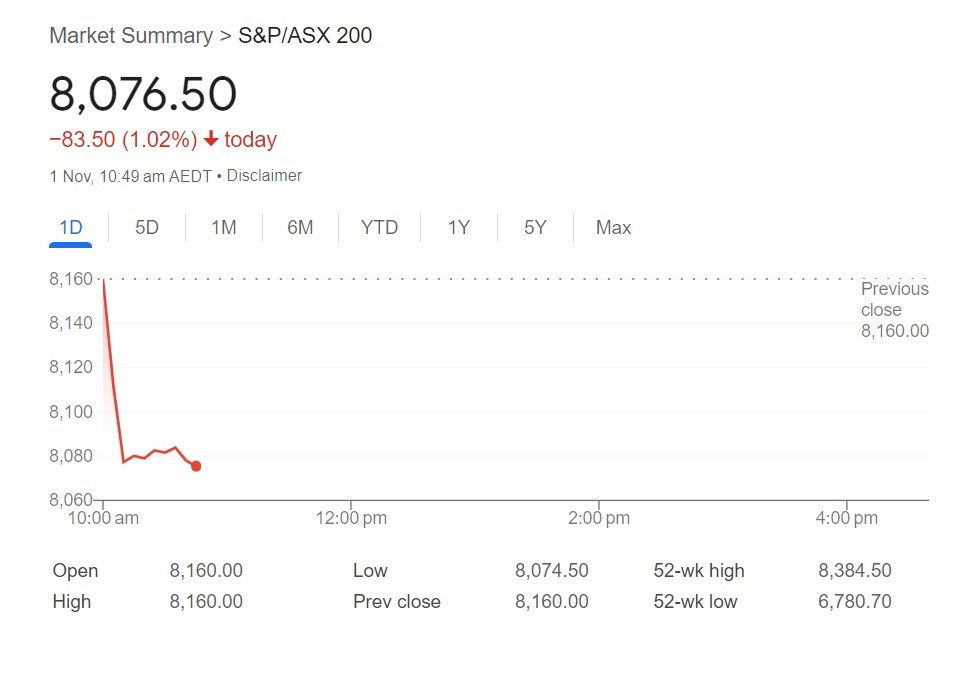

ASX remains in the red

It’s lunchtime (where I am in Sydney at least) and the ASX 200 and All Ords remain in the red, with just a few hours left of the trading week.

Looking at what’s weighing on the market, financials are the worst performers, led by a drop in Macquarie.

Gold stocks are also among the worst performers so far.

It’s a big week ahead for markets with the US election and central bank meetings, including the Reserve Bank.

Household spending falls slightly in September

People tightened the reins in September, with the Australian Bureau of Statistics’ (ABS) household spending indicator falling slightly, down 0.1 per cent in the month.

It following a small (0.2pc) rise in August and no change in July.

“Clothing and footwear was the largest factor in the monthly fall, with spending down 1.8 per cent in this category. This reversed the 1.8 per cent rise in August,” ABS head of business statistics Robert Ewing said.

Households also spent less on transport, due to lower fuel prices and less spending on new cars, but that was offset by more cash going to food and health.

Macquarie shares fall as $1.6b profit misses mark

Shares in Macquarie Group have fallen 4.7 per cent so far this session, after its earnings missed market expectations.

The financial group’s half year net profit came in at $1.6 billion, compared to the $1.7 billion analysts had forecast.

It was 14 per cent above the same period last year, but 23 per cent below last half.

Reduced volatility in energy markets hit Macquarie’s commodities trading arm.

It now expects income from the commodities business to be lower in the short term, unless rising volatility creates opportunities.

“With an earnings miss, downgraded guidance and dividend cut, we expect the stock to trade down today,” Citi analysts said in a note.

Shareholders will receive an interim dividend of $2.60 per share.

“Macquarie continues to maintain a cautious stance, with a conservative approach to capital, funding and liquidity that positions it well to respond to the current environment,” the company said.

It’s a down day for Macquarie shares as Citi expected, but here’s how it’s tracked over the past year:

With Reuters

An overwhelmingly negative day for shares on the ASX 200

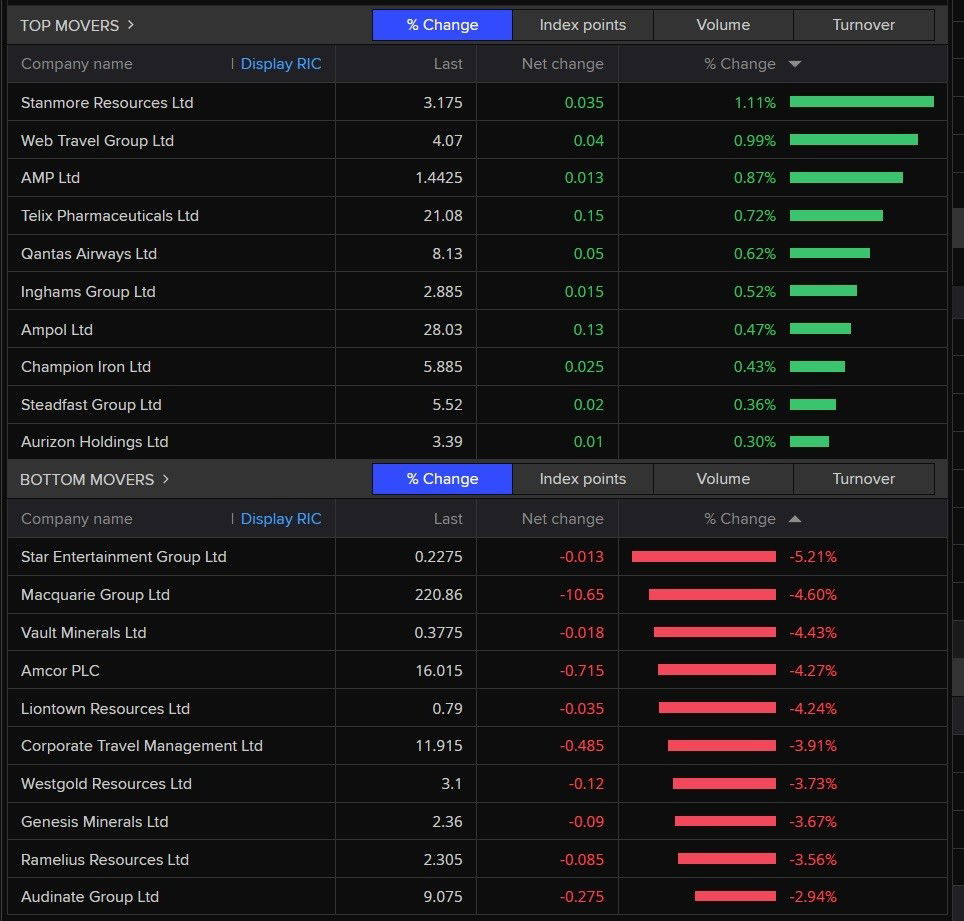

Today’s best performing stock on the ASX 200 is Stanmore Resources (and it’s only up 1.1%)

The stocks which are doing relatively well on this gloomy day include AMP (+0.9%), Qantas (+0.6%) and Inghams (+0.5%).

On the flip side, most companies on the Australian market are experiencing big falls in their share price.

Some of the worst performers include Star Entertainment (-5.2%), Macquarie Group (-4.6%) and Vault Minerals (-4.4%).

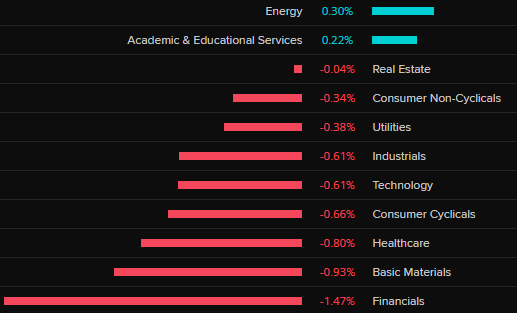

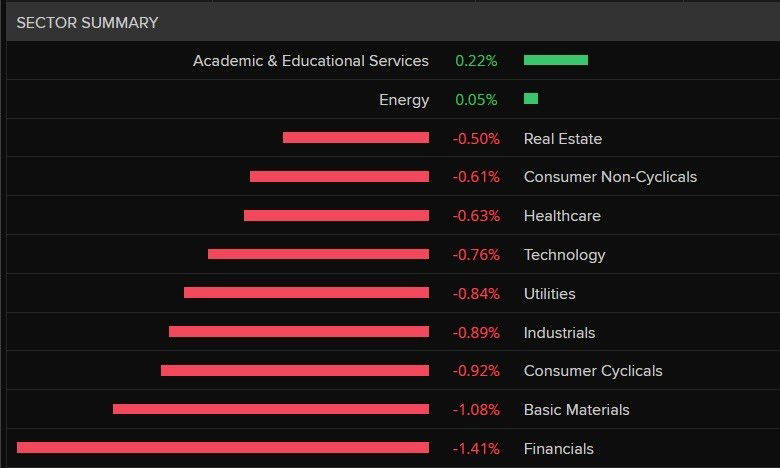

Banks and miners are the biggest drags on the ASX

Almost every sector is trading lower this morning, with financials (-1.4%) and materials (-1.1%) being the worst performers.

The materials sector is being weighed down by Liontown Resources (-4.2%), Amcor (-4.2%) and several gold companies including Westgold Resources (-3.7%).

As for the financial sector, the biggest drags include Macquarie Group (-4.5%), NAB (-1.7%), Suncorp (-1.6%), Insurance Australia Group (-2.1%), Bank of Queensland (-1.8%) and Bendigo and Adelaide Bank (-1.8%).

In addition, 165 out of 200 stocks are in the red (so that’s most of them down):

Australian share market on track to fall 1.6pc this week

This is what a 1% fall on the share market looks like (quite brutal as you can see):

The ASX 200 has now fallen for three straight days.

The negativity started on Wednesday when the ABS released figures showing inflation had fallen to 2.8%, its lowest level in more than three years.

However, it wasn’t low enough for money markets to believe the Reserve Bank can start cutting rates this year.

This morning, the biggest influence on the ASX appears to be the overnight sell-off on Wall Street (with tech stocks driving the Nasdaq down 2.8%).

At this rate, Australia’s benchmark stock index is on track to finish its week lower by 1.6% (when you add up all the losses over the past five days).

ASIC updates Parliament on its investigation into ANZ

The corporat watchdog has been investigating “suspected contraventions” by ANZ since early last year.

ASIC is looking into the Big Four bank’s role as joint lead manager and risk manager on an issuance of $14 billion 10-year Australian government Treasury Bonds conducted on 19 April 2023 by the Australian Office of Financial Management.

Here’s what they just told Parliament about it:

Our investigation is continuing.

We recognise the investigation continues to attract significant public and media interest. To preserve the integrity of the investigation, it is not appropriate to provide ongoing commentary on the investigation.

Our investigation concerns suspected market manipulation and contraventions of a number of provisions of the ASIC Act and the Corporations Act. In August 2024, we expanded our investigation to include suspected contraventions relating to errors in ANZ’s reporting of secondary bond market turnover data to the AOFM.

We are giving this investigation the highest priority given the seriousness of the alleged misconduct and the potential for the alleged conduct to impact the interest payments of the Commonwealth on the bonds issued and therefore Australian taxpayers.

As we have said previously, we expect to form an internal view in the first quarter of 2025 about the suspected contraventions and whether any enforcement action should be taken.

Market snapshot

- ASX 200: -1% to 8,079 points

- Australian dollar: flat at 65.8 US cents

- Wall Street: Dow Jones (-0.9%), S&P 500 (-1.9%), Nasdaq (-2.8%)

- Europe: FTSE (-0.6%), DAX (-0.9%), Stoxx 600 (-1.2%)

- Spot gold: +0.1% to $ US2,747/ounce

- Brent crude: flat at $US72.81/barrel

- Iron ore: +0.3% to $US103.80/tonne

- Bitcoin: +0.7% to $US70,444

Prices current around 10:40am AEDT (live figures below):

ASX 200 opens lower after Wall Street tech losses

It’s down almost 1% to 8,081 points.

The bottom stocks right now are Amcor and Macquarie, both down around 4% each.

ASIC about to appear before parliament

The Parliamentary Joint Committee on Corporations and Financial Services is looking into ASIC, takeovers and corporations legislations.

All the big wigs from the corporate watchdog are slated to appear before them today between 10am and 4pm.

I’ll be bringing you updates when anything juicy happens.

Here’s the link for those keen to listen themselves.

Loading YouTube content

Amazon stocks rise after posting higher quarterly sales results

The online retail giant says faster shipping times and a move to stock lower-costs items helped boost sales.

Margins were higher, especially in its international division outside the United States.

Yet the company is facing heightened competition from discount retailers like Shein and Temu, which sell a wide range of goods at bargain-basement prices sent directly from China.

Six Australians allege they were sexually assaulted by Mohamed Al Fayed

The Egyptian businessman and former Harrods boss, who died last year at the age of 94, is accused of multiple counts of rape, attempted rape and sexual assault by women who worked for him.

He always denied similar accusations before his death, but a BBC documentary unearthed new allegations last month.

A lawyer for the accusers, Bruce Drummond KC, told the ABC that five of the six Australian women who accuse Mr Al Fayed of sexual assault were employed at Harrods, the luxury London department store Mr Al Fayed owned between 1985 and 2010.

He said the other Australian woman was working for a supplier to Harrods. All the women were in their twenties.

Read the exclusive story here:

Search the list of the 1,200 companies that paid zero tax

More than 1,200 large companies paid no tax in 2022-23, the Australian Taxation Office (ATO) has revealed.

It’s the 10th corporate tax transparency report from the ATO — and while the amount of tax collected was higher overall, there were still 31 per cent of companies that didn’t pay tax.

There are various reasons that may be the case, from accounting losses to claiming tax offsets that reduced their tax bill to zero.

ATO Deputy Commissioner Rebecca Saint said there were “legitimate reasons” why a company may pay no income tax, and that the agency plays close attention to ensure that companies “are not trying to game the system”.

You can read the full report from Nassim Khadem and search the full list of companies and what they paid here:

Why the Aussie dollar fell overnight

This note from ANZ just dropped:

The AUD fell as low 0.6540 overnight, weighted down by lower US equities. AUD/USD later reversed the fall and is currently trading near 0.6580.

Today’s ABS monthly household spending indicator (MHSI) for September will provide an important update on spending (11.30am Sydney time).

This is a new and experimental series but has a much broader coverage than yesterday’s retail trade figures (~68% of household consumption compared to 30‑35% for retail trade).

The MHSI has been substantially weaker than retail trade over recent months.

We expect AUD/USD to remain heavy for now because of the impending US election and still solid US economy

Housing market slowed down again in October

Australia’s property market is showing further signs of a slowdown, with national house prices rising slightly in October as more home-owners and investors looked to capitalise on the spring selling season.

Data from CoreLogic showed that the national median house price rose by a modest 0.3 per cent in October to $809,849.

It marks the 21st consecutive month that property prices have risen in the country, however, the modest rise was due to uneven growth in the capital cities.

Read more here:

Microsoft and Meta stocks take a hit on AI costs

Shares of Facebook-owner Meta and Microsoft both fell on Wall Street overnight, despite both companies beating earnings estimates in results reported after the bell on Wednesday.

Amazon, Apple and Google’s Alphabet also fell.

Microsoft and Meta both said their capital expenses are growing due to AI investments, which could reduce profitability.

“You had three of the Magnificent Seven all say they basically have open-ended budgets for AI spend and investors don’t like to hear that,” said Carol Schleif, chief investment officer at BMO Family Office told Reuters.

Apple results beat targets on iPhone 16 sales

One of the world’s biggest tech companies has just released its latest results.

Apple’s sales for the fourth quarter were almost $US95 billion ($144 billion) which beat expectations. They were bumped by strong sales of the latest iPhone.

Yet other product lines missed expectations and the China sales total was less than Wall Street expected, which helped send Apple shares down 1.2% in extended trading.

Its CEO Tim Cook says Apple customers are downloading a new version of its iPhone operating system that uses AI, at twice the rate they were a year ago.

The OS has features like helping people write an email in a “more professional” tone. Some features of it have been delayed.

Apple’s rivals Microsoft and Meta both said this week they expect continued increases in spending to support their AI strategies.

Market snapshot

- ASX 200 futures: -0.7%

- Australian dollar: +0.1% to 65.81 US cents

- Wall Street: Dow -0.9% S&P -1.9% Nasdaq -2.8%

- Europe: FTSE (-0.6%), DAX (-0.9%), Stoxx 600 (-1.2%)

- Spot gold: -1.6% to $ US2,755/ounce

- Brent crude: +0.8% to $US73.17/barrel

- Iron ore: +0.3% to $US103.80/tonne

- Bitcoin: -3.1% to $US69,752

Prices current around 8:00am AEDT (live figures below):

This post was originally published on here