Defensetech has been on the radar of entrepreneurs and founders for a few years now. Sector funding has reached a peak in 2024, according to Crunchbase which has cited $3 billion of funding across 85 deals. Interest started to emerge given Israel’s war with Hamas and Hezbollah and Ukraine’s defense efforts against Russia. In Israel, investors are riding the wave of newly emerged veterans from the Hamas war who leave the IDF and establish defense technologies to solve challenges they experienced in combat.

Alex Shmulovich, Principal at Viola Ventures and author of the report ‘Resilience Tech: Lessons from Israel’s Emerging Resilience Tech Ecosystem’, says that defensetech funding is “unprecedentedly high compared to the past 20 years.”

However, the report has highlighted the ‘Asymmetry Paradox’, which exposes how high spending on defense is not always effective against low-budget attacks. For example, expensive defense systems are often losing against inexpensive, adaptive tactics and civilian innovation is outpacing government-funded research and development. The paradox is most apparent for the IDF which faces increased low-budget drone attacks from Hezbollah and Yemen’s Houthis, as well as Ukraine which is bombarded by drone attacks launched by Moscow.

“The cost gaps between Western top-of-the-line technology and low-cost drones and ballistic missiles is evident in defense-focused technology,” the report stated. “An example of this asymmetry is the April 2024 and October 2024 attacks involving Iranian drones and missiles, which cost an estimated $200 million, while the defensive response by Israel’s air defense systems exceeded $1.1 billion, illustrating a >5x cost disparity.”

The report highlights several unique advantages of Israeli high-tech that position it as a potential leader in the field. These advantages include mandatory military service, particularly in elite units, which fosters exceptional skills and expertise, as well as a proven track record as a global leader in defense technology. Additionally, Israel benefits from a supportive ecosystem strengthened by government funding. The country’s ongoing security challenges further provide a real-world testing ground for developing countermeasures against asymmetrical warfare, enabling rapid technological iteration and refinement.

In accordance with these advantages, the report suggests that Israeli companies are uniquely positioned to excel in several critical areas. In the field of autonomous systems, they can leverage the growing demand for unmanned technologies by focusing on solutions for agile surveillance and unmanned defense capabilities that require minimal human intervention. Examples highlighted in the report include autonomous drones and surveillance robots, which exemplify the potential of such technologies.

Related articles:

Addressing the challenge of next-generation, low-cost kinetic weapons, the report emphasizes the increasing threat posed by inexpensive yet effective tools like drones and ballistic missiles that can bypass traditional defense systems. Israeli companies are well-suited to develop advanced defensive solutions, particularly in missile defense, to counter these evolving risks effectively.

In the area of smart manufacturing for localized production, the report notes the fragility of global supply chains and suggests that Israeli companies could lead in creating solutions for low-volume, high-variance manufacturing. This would involve deploying AI-driven automation and agile supply chain technologies to enable localized production and enhance supply chain resilience.

Real-time intelligence extraction, analysis, and sharing is another promising field where Israeli companies could thrive. As the defense sector increasingly depends on real-time data, there is a significant opportunity to develop AI-powered tools and cloud-based intelligence platforms capable of delivering actionable insights for both military and commercial use.

Finally, the report underscores the importance of resilient communication systems for challenging environments. In remote, hostile, or conflict-prone areas, secure and reliable communication is critical. Israeli companies could innovate in this domain by creating next-generation tactical communication systems and encrypted networks designed to perform effectively in the most demanding conditions.

2 View gallery

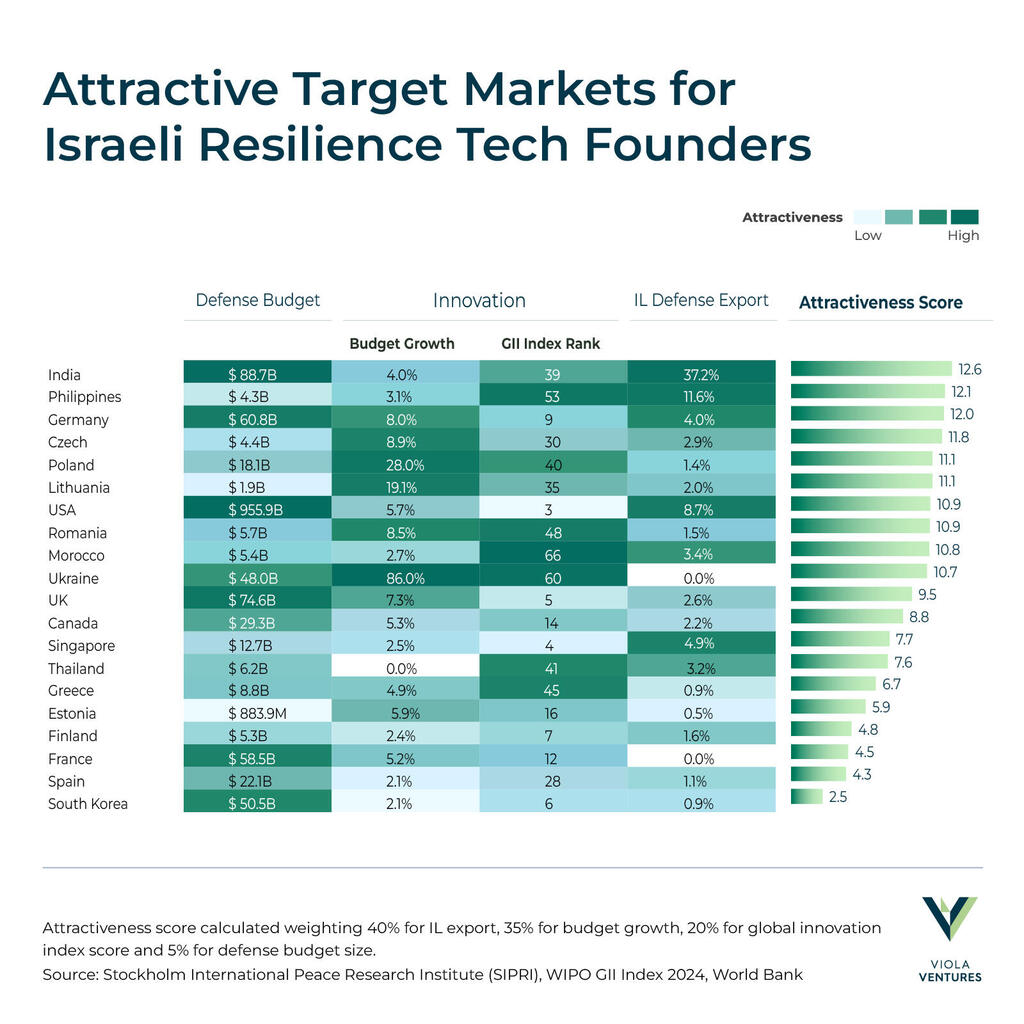

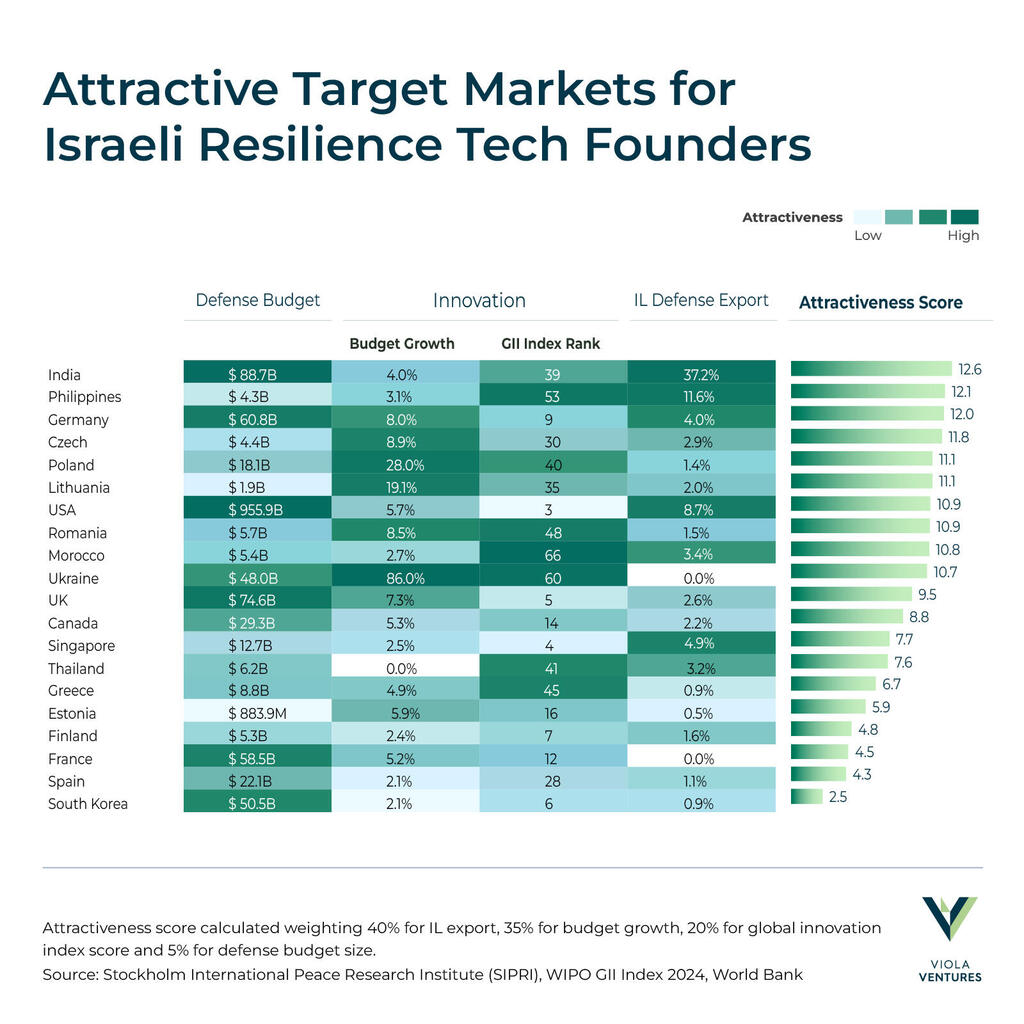

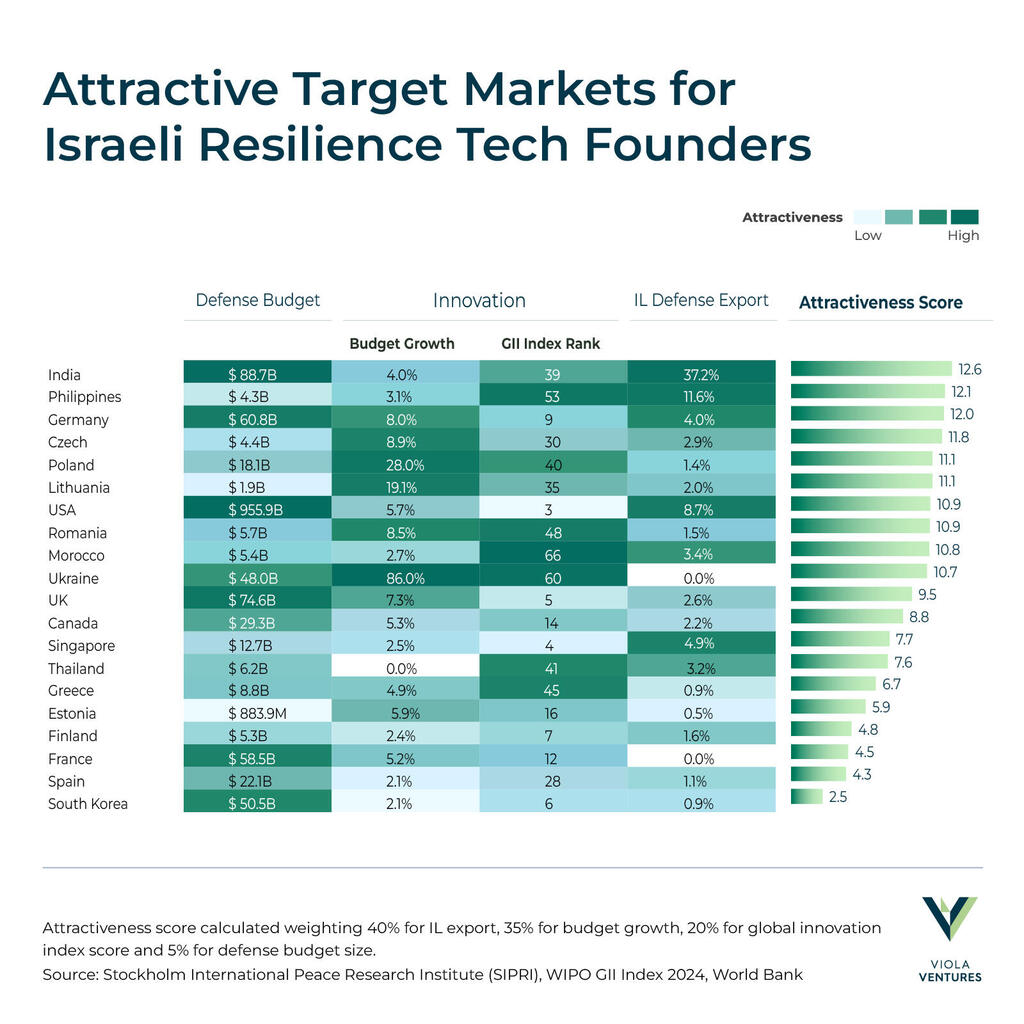

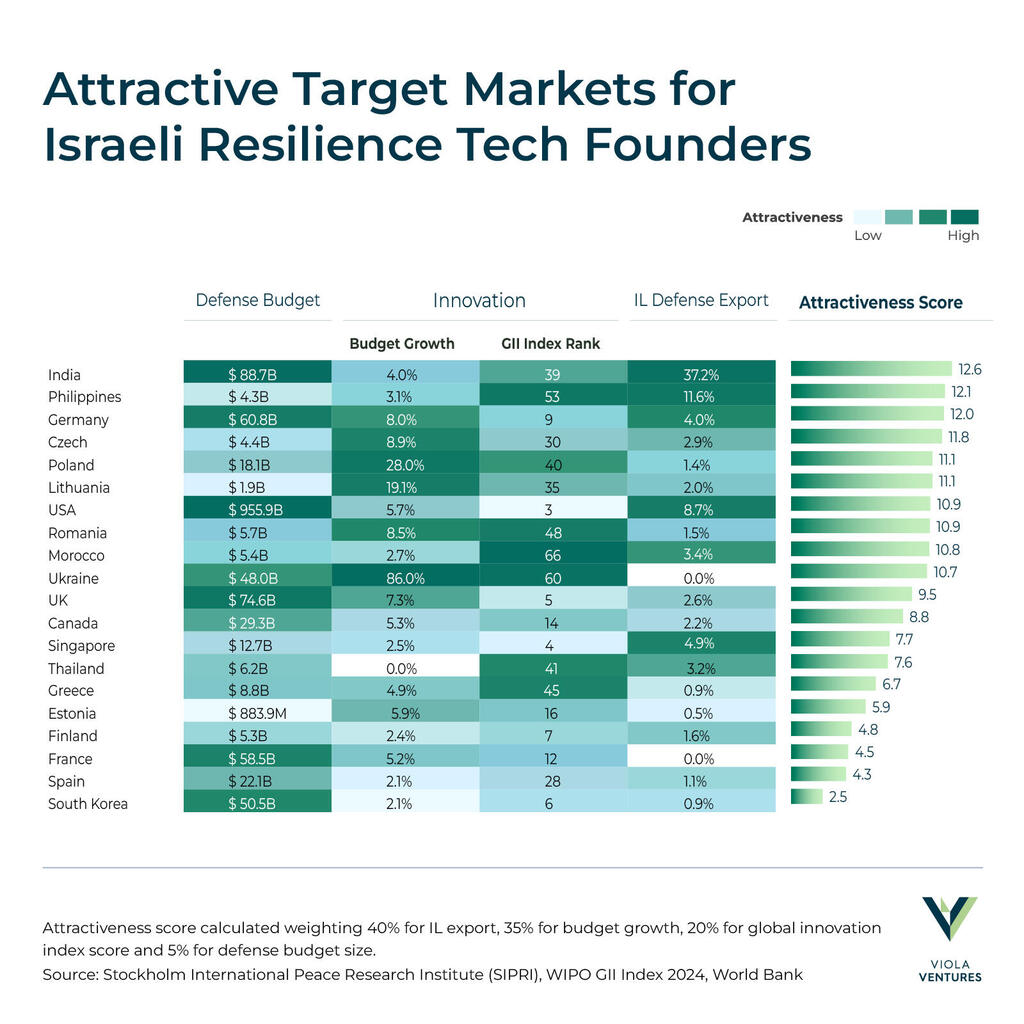

The report hightlights other attractive markets for Israeli defensetech companies

(Photo: Viola Ventures)

The birth of modern-day defensetech can be attributed to the era in the early 21st century with the birth of private tech companies like SpaceX and Palantir. Before that, there were the usual legacy enterprises comprised of Lockheed Martin, Boeing, RTX, Northrop Grumman, and General Dynamics. These typically worked with government agencies until startups in the new era started establishing their own contracts. Today, many more disruptive companies have broken into the consolidated market with their dual-use technologies that can also be applied to surveillance, intelligence, law enforcement, or military applications.

The challenge for new companies is finding a geographic focus that may be outside the U.S., which is bound by regulations, cronyism, and tight security clearances.

According to a new index designed by Shmulovich based on a variety of factors including defense budgets defense exports, and an ‘attractiveness score’, the most ideal markets for Israeli defensetech companies are India, the Philippines, Germany, the Czech Republic, and Poland, with the United States resting in seventh place. Germany, a NATO country, has seen an increased defense budget of 8% over the last five years and Ukraine has seen a whopping jump of 83% due to its ongoing conflict. India is the fourth-highest spender overall with a 2023 defense budget of $88.7 billion.

“People talk about the U.S., China, and Russia, but India is like the fourth superpower,” Shmulovich said, highlighting its 4% compound annual growth rate since 2019. “They have a lot of technological competency in the country. They have a relatively vibrant startup ecosystem and a lot of innovation, and they also have conflicts. It’s not about just the conflict, it’s about showing power right in the region. That region is relatively volatile with China, Tibet, and some of the other borders they have. And so they invest a lot in defense.”

Israel and the USA have enjoyed a close relationship, particularly regarding defensetech. However, it has shown to be a challenging market to penetrate as prime local companies like Anduril secure billion-dollar deals with U.S Special Operations Command which can disrupt traditional defense R&D without the headache of being a foreign company seeking security clearances. Israeli companies who may have “some kind of an American affiliation on a personal level”, are encouraged to outpace the established contractor competitors by focusing on four key pillars: Talent Arbitrage, Modular Platforms, Low Cost Offerings, and Localization of Production.

“There is a question on how startups can win compared to these like very well-funded companies that have great access to the buyers and assets,” Shmulovich explained. “It’s really around two areas: One is bringing AI talent, which currently is a bit scarce in the traditional defense industry… the second point is around low cost offerings. So you can do that either through productizing and modulation, building something that has deep technology for various use cases, or just avoiding the inefficiencies of defense front contractors.”

As long as defensetech enjoys a boom in attraction, questions will arise about whether it truly is a new frontier of Israeli tech or if it will be the latest trend to catch the eyes of investors. For now, Israel enjoys a choice between regions and markets and should consider all options.

This post was originally published on here