News24 Business | Surge in cancer among young SA men shows need for income protection

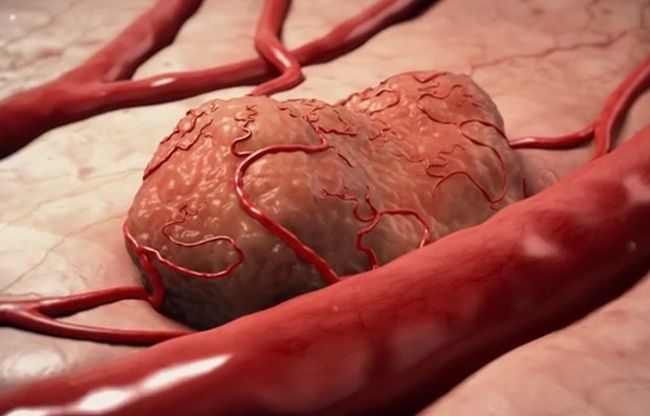

Claims statistics highlight the need for income protection cover that pays out an ongoing income, particularly at younger ages.Income protection is a policy that pays out a monthly income benefit if you are disabled.Momentum has seen a dramatic increase in cancer in men under 40. For more financial stories, go to the News24 Business front page.Losing your income, even temporarily, can be financially devastating. Your income pays for everything in your life, so unless you are nearing retirement and have substantial assets, you will not survive unscathed.The most vulnerable years are up to our mid-40s, when we are focused on building our careers, growing our net worth, and, in many cases, raising a family. Income protection is crucial at this time.Young and bulletproofYounger people often believe that life insurance isn’t necessary and that money would be better spent elsewhere.”Living expenses take priority,” says George Kolbe, head of life insurance marketing at Momentum. “But as people become more aware of their own mortality or their families grow, they realise they need to insure themselves against a loss of income.”Claims statistics highlight the need for income protection cover that pays out an ongoing income, particularly at younger ages. Income protection is a policy that pays out a monthly income benefit if you are disabled, as defined in the policy.According to Bidvest Life’s claims statistics for 2023, clients aged 28 to 43 (millennials) accounted for 50% of all income protection claims.The statistics from Momentum Life tell a similar story, with around 25% of their income protection claims coming from clients under the age of 40. The next 35% of claims are made by those in their forties.At Old Mutual, clients under the age of 40 account for around 28% of the income protection claims.Policyholders were 17 times more likely to claim on their income protection benefits than on their life cover across all age groups, according to Bidvest Life.”This increases dramatically among millennials, who were 55 times more likely to claim on their income protection benefits than life cover benefits,” Nic Smit, Bidvest Life product and pricing executive, says.This is not surprising given that claiming for life cover is a once-off event. However, if your income protection policy is active and the claim is valid, you can claim income protection more than once.”In 2023, 49% of our income protection claims were made by policyholders who had previously claimed on the same policy,” Smit says, adding that 11% of them had claimed four or more times before.Cancer in men is on the riseBidvest Life’s experience is that childbirth is the most common claim event for younger clients aged 28 to 43, but claims for minor infections and cancer occur across all ages.Although musculoskeletal conditions account for 27% of income protection claims at Momentum, claims relating to the nervous system (14%), cancer (13%) and psychiatric and mental conditions (11%), such as severe depression, are also significant.”We have seen a dramatic increase in cancer in men under 40, from 7% in 2022 to 22% in 2023,” Kolbe says.”It is a stark reminder that men, regardless of age, must prioritise their health and financial security.”Your waiting period matters The longer you are prepared to wait before you claim on an income protection policy, the lower your premium, but don’t make the cost your main deciding factor when it comes to waiting periods. (Waiting periods are a length of time during which you cannot claim on a policy or from a medical scheme for all or certain benefits.)If you are unable to work due to illness or an accident, several factors come into play. If you’re employed, your first source of income protection is sick leave. You are entitled to 36 days of paid sick leave in every three-year cycle.If your employer provides group benefits that include income protection, this provides an additional layer of protection. Kolbe emphasises the importance of understanding the rules and how long you will be covered. “If you don’t have these benefits or are self-employed, you are far more vulnerable,” he adds.Waiting periods on income protection policies typically range from seven days to 30 days but can be as long as 90 days.In 2023, the average length of time for which Bidvest Life paid an income protection claim was 71 days, so if your claim was for this average period or less, selecting a 90-day waiting period would result in no chance of claiming.Furthermore, 42% of income protection claims lasted less than 30 days, highlighting the importance of considering the wisdom of even a seven- or 14-day waiting period if you want to ensure your financial needs and risks are adequately met.Younger clients claim on their income protection benefits for a shorter period of time than the overall average. “For clients younger than 28, the average claim period was 40 days,” Smit explains. “For those aged 28 to 43, it was 60 days, so choosing a shorter waiting period benefits them.”Remember: Lump sum vs income benefit There are two ways to protect your income: using disability cover that pays out a lump sum benefit or an income protection policy. A lump sum disability benefit can only be claimed if you are permanently disabled, whereas income protection can also be claimed if you are temporarily unable to work due to illness or an accident. Some income protection claims can become permanent if you don’t recover, Kolbe says.Income protection should be the first priority, particularly if you are in the vulnerable years of establishing a career and possibly a family. Having the right cover reduces financial risks and protects your lifestyle.Sylvia Walker is a financial planner at Andrew Prior Consultants. This article was first published on SmartAboutMoney.co.za, an initiative by the Association for Savings and Investment South Africa (ASISA). News24 cannot be held liable for any investment decisions made based on the advice given by independent financial service providers. Under the ECT Act and to the fullest extent possible under the applicable law, News24 disclaims all responsibility or liability for any damages whatsoever resulting from the use of this site in any manner.